The book is praised for its detailed and well-researched account of the financial crisis. The reviewer finds it to be a valuable addition to the literature on the subject.

The reviewer appreciates the book's detailed and well-researched account of the financial crisis. They find it to be a valuable addition to the literature on the subject, providing new insights and perspectives. The reviewer notes that the book is not just a retelling of events but a deep dive into the underlying causes and factors that led to the crisis. They commend the authors for their thorough investigation and clear explanation of complex financial concepts.

Quick quotes

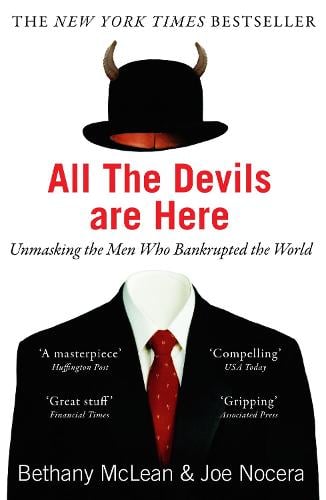

THE latest book on the financial crisis has an odd title.

You begin reading “All the Devils Are Here”, a line from Shakespeare's “The Tempest”

It is a valuable addition to the literature on the subject.